Time to Get Paid: Everything You Need to Know About the Sick Leave Credit Self Employed

Being self-employed is fantastic—you are your own boss, set your own schedule, and control your income. But what happens when you get sick? Unlike traditional employees who rely on employer-provided paid time off, self-employed individuals often face the difficult choice between health and income.

Fortunately, during certain challenging periods, the government introduced the Sick Leave Credit Self Employed mechanism to help bridge this gap. This tax credit provides financial relief when you are unable to work due to specific health-related reasons, effectively treating your lost income as paid sick leave.

If you are self-employed and lost income because of illness or the need to care for others, understanding this credit is crucial. It's not a grant or a loan; it's a refundable credit designed to offset your self-employment taxes, putting money back into your pocket.

Understanding the Sick Leave Credit Self Employed

This tax credit was established under specific federal legislation (like the Families First Coronavirus Response Act, FFCRA, and later expansions) to support self-employed individuals who had to miss work due to COVID-19 related circumstances. While the specific legal framework has sunset, understanding the rules is essential for those who may need to claim it or amend past returns.

Essentially, the Sick Leave Credit Self Employed treats you as both the employer and the employee. As the "employee," you receive the sick leave; as the "employer," you get a corresponding tax credit against your business's taxes (or self-employment taxes) to cover that cost.

It is important to realize that this credit is tied directly to your net earnings from self-employment. You must have had income to lose during the period you were sick or caring for someone else in order to claim the credit.

Who Qualifies for This Credit?

To be eligible to claim the Sick Leave Credit Self Employed, you generally need to meet two main criteria. First, you must have been carrying on a trade or business that would qualify you for self-employment income.

Second, you must have been unable to work (or telework) because you met a specific health-related condition as defined by the legislation. These reasons were typically very strict and required proper documentation.

The qualifying reasons for taking leave generally fell into these categories:

- You were subject to a federal, state, or local quarantine or isolation order related to COVID-19.

- You were advised by a healthcare provider to self-quarantine due to COVID-19 concerns.

- You were experiencing COVID-19 symptoms and seeking a medical diagnosis.

- You were caring for an individual subject to a quarantine or isolation order.

- You were caring for a child whose school or place of care was closed due to COVID-19 precautions.

You must also have documentation that supports your inability to work. This documentation might include official quarantine orders, advice from a doctor, or school closure notices.

What is the Timeframe We Are Talking About?

The rules governing the Sick Leave Credit Self Employed were split into specific periods. It is absolutely essential to know which period your lost work days fall into because the caps and calculations changed.

The first period typically covered April 1, 2020, through March 31, 2021. The second period, which offered a fresh allowance of days, generally covered April 1, 2021, through September 30, 2021.

You cannot combine days from different periods to exceed the daily limit for any single period. For example, if you used 10 days of personal sick leave in 2020, you were eligible for a new batch of days if you qualified in the 2021 period.

Calculating Your Sick Leave Credit

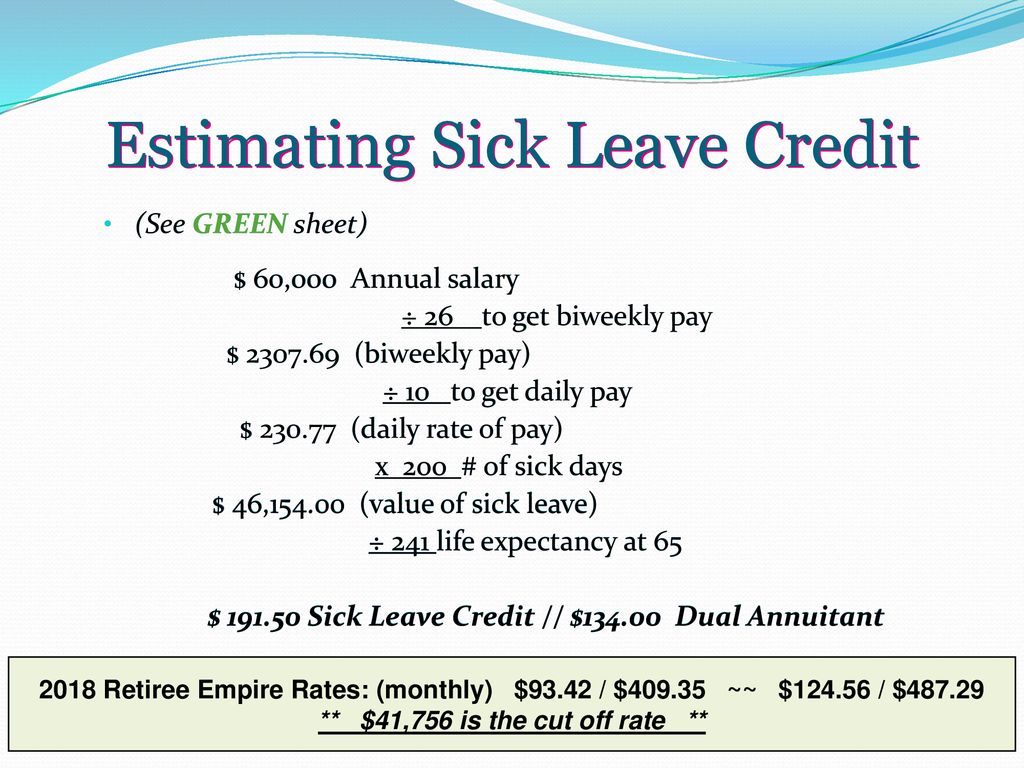

The calculation of your credit depends entirely on your average daily self-employment income and the reason for your leave. The IRS sets maximum limits on both the number of days you can claim and the dollar amount per day.

The credit is based on 100% of your qualified sick leave wages (up to a limit) or 67% of qualified family leave wages (up to a limit), multiplied by the number of days you missed.

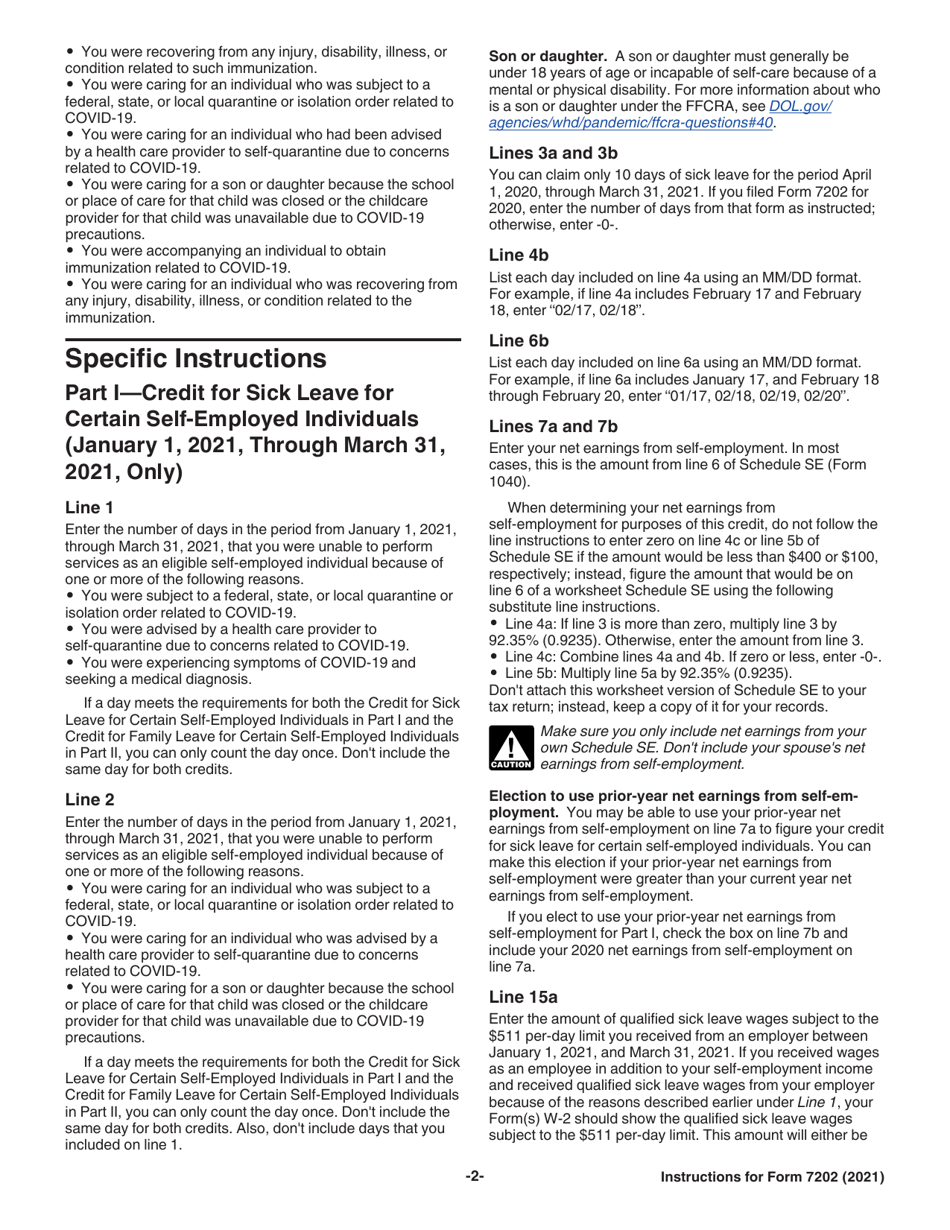

To determine your "daily equivalent," you generally take your net earnings from self-employment for the year and divide it by 260 working days.

How Much Can You Claim?

The limits are broken down based on the type of care you provided. These limits are non-negotiable and are crucial when calculating the total value of your Sick Leave Credit Self Employed.

Personal Illness Leave (Your Illness)

If you were sick yourself or seeking diagnosis, you could claim up to 10 days of leave across the qualifying period. The maximum daily credit allowed for personal illness was capped at $511 per day.

This means the total potential credit for personal illness was capped at $5,110 for each specific eligibility period.

Caregiver Leave (Caring for Others)

If you were caring for another individual or tending to a child whose school was closed, you could also claim up to 10 days of leave. However, the daily cap was significantly lower in this scenario.

The maximum daily credit for caregiver leave was capped at $200 per day. The total potential credit for this type of leave was capped at $2,000 for each specific eligibility period.

The Difference Between Sick Leave and Family Leave Credits

Although they are often claimed together, the credits for sick leave and family leave operate under different rules and caps. Understanding these distinctions is vital for accurate tax filing.

Here is how the two types of credits differ:

- Sick Leave (Personal Health): This covers you being incapacitated, under quarantine, or seeking a diagnosis. The daily credit is based on 100% of your average daily income, up to $511. The maximum days allowed is 10.

- Family Leave (Caring for Others): This covers you caring for a quarantined family member or a child whose school is closed. The daily credit is based on 67% of your average daily income, up to $200. The maximum days allowed is 50 (when considering the expanded period for family leave).

You must track these days separately. If you claimed 5 days of personal sick leave, you still had your full allowance of family leave days available, provided you met the eligibility requirements for the applicable time period.

The Filing Process: Getting Your Money Back

Claiming the Sick Leave Credit Self Employed requires specific tax forms. You cannot simply list the lost income on your standard Schedule C.

Since this credit is designed to offset your self-employment tax, you will need to utilize a specific IRS form that calculates the credit based on your net earnings reported on Schedule SE (Self-Employment Tax).

Required Forms and Documentation

The primary form used to calculate the self-employment sick and family leave credit is Form 7202. This form is where you detail the number of eligible days, the reason for the leave, and your average daily income calculation.

Once Form 7202 is completed, the resulting credit amount is carried over to your primary tax form (like Form 1040, Schedule 3) to reduce your total tax liability, making it a refundable credit if the amount exceeds your existing taxes.

Crucially, keep all supporting documentation in case the IRS audits your claim. This includes dated notes from doctors, official quarantine orders, and records of the specific days you were unable to work.

Key Tips for Accurate Filing

Filing for the Sick Leave Credit Self Employed can be complex due to the multiple timeframes and different caps. Here are a few tips to ensure accuracy:

- **Verify Net Earnings:** Ensure the income used to calculate your daily rate (Form 7202) matches the net earnings reported on your Schedule C/Schedule K-1.

- **No Double Dipping:** If you are self-employed but also have W-2 wages where you used paid sick leave, you cannot claim the credit for those same days of lost work.

- **Choose the Higher Year:** For the 2021 credit period, you were sometimes allowed to use your 2019 or 2020 net earnings to calculate the daily rate, depending on which one was higher. Be sure to utilize this benefit if applicable.

- **Amended Returns:** If you missed claiming this credit on a prior year's return, you may still be able to file an amended return (Form 1040-X) to claim the refund.

If you feel overwhelmed by the calculations or the required forms, consulting with a tax professional specializing in self-employment taxes is highly recommended. They can ensure you maximize the credit while staying compliant with IRS regulations.

Conclusion

The availability of the Sick Leave Credit Self Employed was a vital financial lifeline for individuals running their own businesses during periods of mandatory or medically advised absence. While the claiming periods have passed, the opportunity to amend past returns to claim this substantial credit may still exist.

Remember that the rules are specific: you must have qualifying self-employment income, your inability to work must match the eligible reasons, and you must accurately calculate the daily caps for both personal and family leave. If you believe you missed out on this benefit, revisit your tax returns and explore filing Form 7202 to secure your rightful Sick Leave Credit Self Employed.

Don't leave money on the table—a careful review of your records could result in a significant refund.

Frequently Asked Questions (FAQ) About the Sick Leave Credit Self Employed

- What tax form is used to claim the Sick Leave Credit Self Employed?

- The primary form used to calculate and claim this credit is IRS Form 7202 (Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals). The resulting credit is then reported on Schedule 3 (Additional Credits and Payments).

- Is the Sick Leave Credit Self Employed still available for current tax years?

- No. The specific legislation authorizing the self-employed sick and family leave credits (FFCRA and related expansions) covered specific dates, primarily in 2020 and 2021. The program has expired and is not available for lost income in current tax years.

- If my business had zero net income, can I still claim the credit?

- Unfortunately, no. The credit is calculated based on your net earnings from self-employment. If your business had zero or negative net earnings for the year, you have no income "to replace," and therefore, you cannot claim the credit.

- What if I was an employee for part of the year and self-employed for the rest?

- The maximum days and dollar amounts apply across both employment types. If you received paid sick leave as an employee (W-2 wages), those days reduce the number of eligible days you can claim through the Sick Leave Credit Self Employed mechanism.

Sick Leave Credit Self Employed

Sick Leave Credit Self Employed Wallpapers

Collection of sick leave credit self employed wallpapers for your desktop and mobile devices.

Amazing Sick Leave Credit Self Employed Landscape Digital Art

Explore this high-quality sick leave credit self employed image, perfect for enhancing your desktop or mobile wallpaper.

Serene Sick Leave Credit Self Employed View Digital Art

Experience the crisp clarity of this stunning sick leave credit self employed image, available in high resolution for all your screens.

Lush Sick Leave Credit Self Employed Moment Digital Art

Immerse yourself in the stunning details of this beautiful sick leave credit self employed wallpaper, designed for a captivating visual experience.

Vivid Sick Leave Credit Self Employed Scene Illustration

Transform your screen with this vivid sick leave credit self employed artwork, a true masterpiece of digital design.

Gorgeous Sick Leave Credit Self Employed Picture Photography

This gorgeous sick leave credit self employed photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic Sick Leave Credit Self Employed Moment Nature

Immerse yourself in the stunning details of this beautiful sick leave credit self employed wallpaper, designed for a captivating visual experience.

Exquisite Sick Leave Credit Self Employed Image for Your Screen

A captivating sick leave credit self employed scene that brings tranquility and beauty to any device.

Breathtaking Sick Leave Credit Self Employed Background for Desktop

Experience the crisp clarity of this stunning sick leave credit self employed image, available in high resolution for all your screens.

Exquisite Sick Leave Credit Self Employed Artwork Photography

A captivating sick leave credit self employed scene that brings tranquility and beauty to any device.

High-Quality Sick Leave Credit Self Employed Abstract Digital Art

Experience the crisp clarity of this stunning sick leave credit self employed image, available in high resolution for all your screens.

Vibrant Sick Leave Credit Self Employed Moment in 4K

Discover an amazing sick leave credit self employed background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Beautiful Sick Leave Credit Self Employed Scene Concept

Experience the crisp clarity of this stunning sick leave credit self employed image, available in high resolution for all your screens.

Exquisite Sick Leave Credit Self Employed Landscape for Desktop

A captivating sick leave credit self employed scene that brings tranquility and beauty to any device.

Detailed Sick Leave Credit Self Employed Wallpaper Collection

Explore this high-quality sick leave credit self employed image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant Sick Leave Credit Self Employed Background for Desktop

Experience the crisp clarity of this stunning sick leave credit self employed image, available in high resolution for all your screens.

Artistic Sick Leave Credit Self Employed Photo for Your Screen

A captivating sick leave credit self employed scene that brings tranquility and beauty to any device.

Mesmerizing Sick Leave Credit Self Employed Moment Nature

Discover an amazing sick leave credit self employed background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vibrant Sick Leave Credit Self Employed Abstract for Desktop

Explore this high-quality sick leave credit self employed image, perfect for enhancing your desktop or mobile wallpaper.

Artistic Sick Leave Credit Self Employed Background Nature

Immerse yourself in the stunning details of this beautiful sick leave credit self employed wallpaper, designed for a captivating visual experience.

High-Quality Sick Leave Credit Self Employed Moment Illustration

Discover an amazing sick leave credit self employed background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Download these sick leave credit self employed wallpapers for free and use them on your desktop or mobile devices.