What Happens 401K When You Leave Company: Your Ultimate Guide

So, you've decided to move on to a new opportunity. Congratulations! You've already navigated the interview process, given notice, and maybe even started packing your desk. But wait—there's one massive question mark hanging over your head: What Happens 401K When You Leave Company?

Dealing with your retirement savings can feel daunting, especially when juggling a career change. However, understanding your options is crucial for protecting your financial future. Spoiler alert: You have several choices, but some are much better than others.

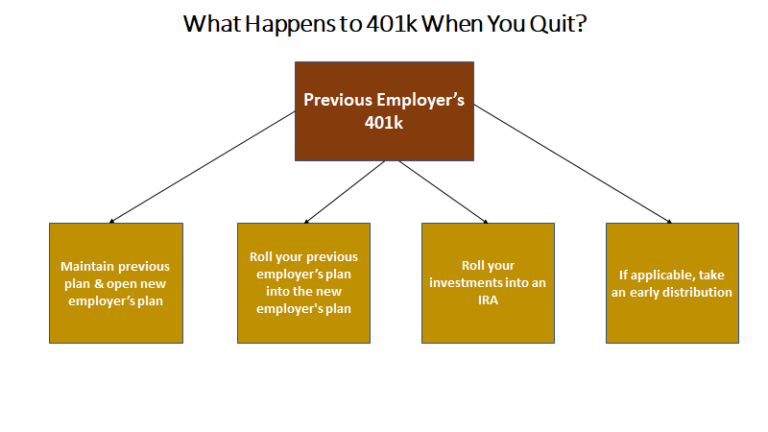

In this guide, we'll walk you through the four main paths you can take with your old 401K, detailing the pros, cons, and tax implications of each. Let's make sure those hard-earned retirement dollars stay safe and continue growing!

Understanding Your 401K Options After Separation

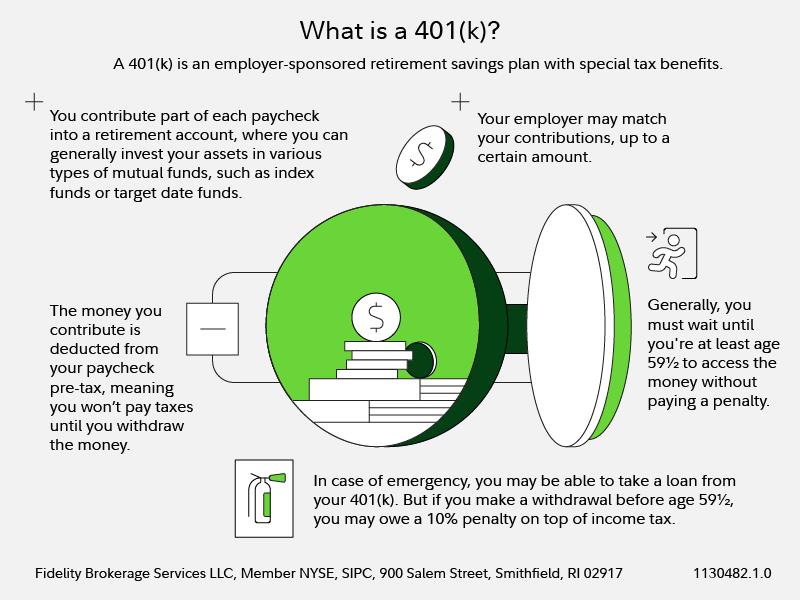

When you leave an employer, your 401K balance doesn't vanish; it simply becomes inactive in terms of new contributions. The money you've saved and the earnings you've accrued are 100% yours, but you must decide what to do with them. Typically, you have four main avenues to choose from, depending on your account balance and your new job situation.

Leaving Your 401K Where It Is (The "Hands-Off" Approach)

If your account balance is high enough—usually $5,000 or more—your former employer will often allow you to leave the funds in their existing plan. This is the path of least resistance right now, but it might not be the smartest long-term decision.

While this option is easy, keep in mind that you might lose access to certain features, like taking out loans against the balance. More importantly, you're giving up control over the account and the investment choices available. You may also face higher administrative fees compared to a personal IRA.

Minimum Balance Requirements for Keeping Your Account

If your vested balance is less than $5,000, your former employer usually has the right to force you out of the plan. If the balance is under $1,000, they will likely mail you a check (cashing out, which you should try to avoid!). If it is between $1,000 and $5,000, they often roll it automatically into an IRA of their choosing, known as a "default IRA."

Rolling Over Your 401K to an IRA (The Popular Choice)

This is often the best choice for financial freedom and flexibility. A 401K rollover into an Individual Retirement Account (IRA) allows you to consolidate your funds and access a much wider range of investment options, often with lower fees.

When you initiate a rollover, you transfer the funds tax-free and penalty-free. The key is to execute what is known as a Direct Rollover. Let's clarify how that works.

Direct vs. Indirect Rollover: Why the Distinction Matters

There are two primary methods for moving your money, and choosing the wrong one can cost you dearly in taxes and penalties.

- Direct Rollover: This is the recommended method. The funds are moved directly from your old 401K administrator to your new IRA custodian (or new 401K plan). The money never touches your bank account, thus avoiding any required tax withholding or potential penalties.

- Indirect Rollover: In this scenario, the 401K administrator sends the money to you (the participant). By law, they must withhold 20% for federal taxes. You then have exactly 60 days to deposit the *entire* amount (including the 20% the IRS held back) into the new IRA. If you miss the 60-day deadline, or if you can't come up with the 20% withheld amount from other funds, the IRS treats the withheld money as a taxable distribution, plus you pay the 10% early withdrawal penalty (if under 59 1/2).

Always request a Direct Rollover when leaving a company. It simplifies the process significantly and eliminates the stress of the 60-day clock and the tax withholding issue.

Rolling Over to Your New Employer's 401K (Keeping It Simple)

If you prefer to keep all your retirement savings under one roof, rolling your old 401K into your new employer's plan is a fantastic option. This is especially useful if your new plan offers excellent investment choices and low fees.

The main advantage here is simplicity and consolidation. You'll only have one account to track, monitor, and manage. Furthermore, 401K plans sometimes offer greater protection from creditors than IRAs, though this varies by state.

Before choosing this route, however, thoroughly review the new plan's offerings. Make sure the funds available meet your needs and that the administrative costs aren't excessive. If the new plan is mediocre, an IRA rollover might be better.

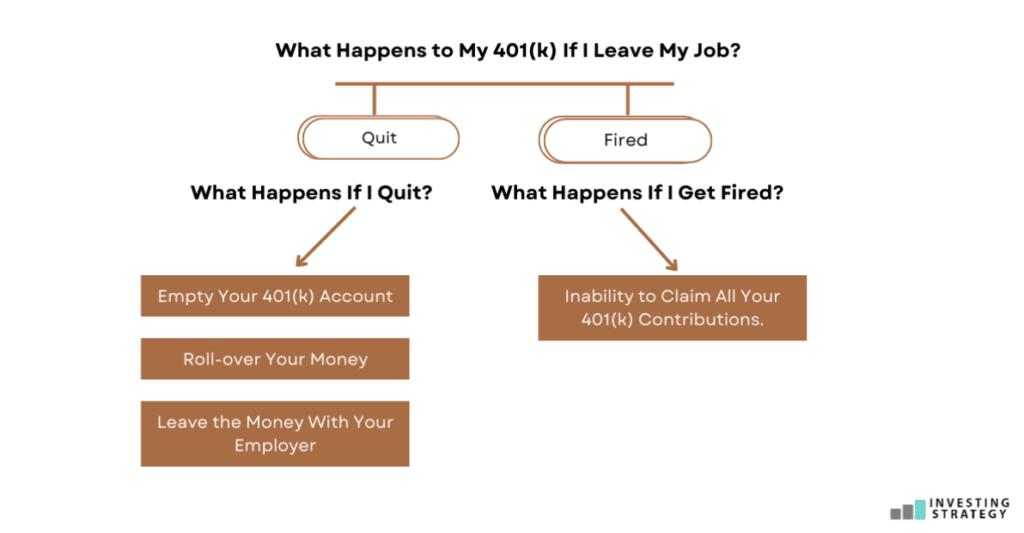

Cashing Out Your 401K (The Option to Avoid)

This is the option that screams "STOP!" while flashing red sirens. While tempting during a transition period, taking a lump-sum distribution—or "cashing out"—should almost always be avoided. This choice comes with severe financial consequences.

When you cash out, you must pay regular income tax on the entire distribution. But wait, there's more. If you are under the age of 59 1/2, you will also be hit with a mandatory 10% early withdrawal penalty from the IRS. This can easily result in losing 30-40% of your savings immediately to taxes and penalties.

Even worse than the immediate financial hit is the long-term cost. By removing that money, you lose years, potentially decades, of compounding growth. That small balance today could have grown into hundreds of thousands of dollars by retirement.

Action Steps: How to Handle Your Old 401K Smoothly

Deciding what happens 401K when you leave company requires proactive steps. Don't wait until the last minute!

- Determine Your Vested Balance: Contact your previous administrator to confirm your 100% vested balance and verify any deadlines they might impose for moving the money.

- Review New Plan Options: If rolling into a new 401K, get the summary plan description from your new HR department. If rolling into an IRA, research custodians (like Fidelity, Vanguard, Schwab) and compare fees and investment offerings.

- Choose the Direct Rollover Path: Contact the financial institution where you want the money to end up (the new IRA custodian or new 401K administrator). They will often handle the paperwork with your former employer to ensure the transfer is direct and tax-free.

- Follow Up: Transfers can sometimes take several weeks. Confirm with both the old and new institutions that the funds have been transferred correctly.

Remember that you usually have a "use it or lose it" period for moving the funds, though the IRS doesn't enforce a specific deadline for rollovers unless the employer forces a distribution (i.e., if your balance is low). Taking action within 60-90 days of separation is generally best practice.

Conclusion: The Best Choice for Your Financial Future

The transition between jobs brings many stresses, but handling your retirement savings doesn't have to be one of them. While you have four choices for what happens 401K when you leave company, the best course of action is almost always a Direct Rollover, either into a personal IRA for maximum flexibility or into your new employer's 401K for consolidation.

Cashing out should be treated as a last resort, reserved only for extreme financial emergencies, as the penalties and lost growth are simply too severe to justify. Take control of your retirement today—a quick rollover ensures your money keeps working hard for you, no matter where your career takes you next.

Frequently Asked Questions (FAQ)

- What is the difference between rolling over a 401K to an IRA and cashing it out?

- A rollover is a tax-free transfer of funds directly into another retirement account, preserving its tax-advantaged status. Cashing out (taking a distribution) means you withdraw the money, making it immediately subject to income tax and a 10% penalty if you are under 59 1/2.

- How long do I have to decide what to do with my old 401K?

- If your vested balance is over $5,000, you can generally leave the money indefinitely in the former plan. However, if your balance is less than $5,000, your former employer may force a distribution, requiring you to make a choice quickly (or they will automatically place it into a default IRA).

- Will I lose my matching contributions if I leave the company?

- You only keep the employer matching contributions that have "vested." Vesting schedules vary, but once an amount is vested, it is 100% yours, even if you leave the company the next day. Unvested amounts are forfeited back to the company.

- Can I roll a Roth 401K into a Traditional IRA?

- No. Roth funds must be rolled into either a Roth IRA or a Roth 401K. If you accidentally roll Roth funds into a Traditional (pre-tax) account, it could trigger a taxable event.

- What if I don't have a new job yet?

- If you don't have a new employer with a 401K plan yet, the best option is typically to roll the funds into an IRA. This gives you immediate control over the investments, flexibility, and avoids potential fees from the old employer's plan while you search for your next role.

What Happens 401K When You Leave Company

What Happens 401K When You Leave Company Wallpapers

Collection of what happens 401k when you leave company wallpapers for your desktop and mobile devices.

Crisp What Happens 401k When You Leave Company Wallpaper for Your Screen

Immerse yourself in the stunning details of this beautiful what happens 401k when you leave company wallpaper, designed for a captivating visual experience.

Vibrant What Happens 401k When You Leave Company Picture for Desktop

Explore this high-quality what happens 401k when you leave company image, perfect for enhancing your desktop or mobile wallpaper.

:max_bytes(150000):strip_icc()/howtotakemoneyoutofa401kplan-79531c969f74433db11c032e3cfd3636.png)

Vivid What Happens 401k When You Leave Company View Collection

Discover an amazing what happens 401k when you leave company background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite What Happens 401k When You Leave Company Moment Art

This gorgeous what happens 401k when you leave company photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic What Happens 401k When You Leave Company Wallpaper in 4K

This gorgeous what happens 401k when you leave company photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic What Happens 401k When You Leave Company Wallpaper Concept

A captivating what happens 401k when you leave company scene that brings tranquility and beauty to any device.

Mesmerizing What Happens 401k When You Leave Company Landscape Art

Discover an amazing what happens 401k when you leave company background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite What Happens 401k When You Leave Company Background in 4K

Immerse yourself in the stunning details of this beautiful what happens 401k when you leave company wallpaper, designed for a captivating visual experience.

Gorgeous What Happens 401k When You Leave Company Photo in 4K

Find inspiration with this unique what happens 401k when you leave company illustration, crafted to provide a fresh look for your background.

Stunning What Happens 401k When You Leave Company Picture Concept

Find inspiration with this unique what happens 401k when you leave company illustration, crafted to provide a fresh look for your background.

Detailed What Happens 401k When You Leave Company Abstract Digital Art

Experience the crisp clarity of this stunning what happens 401k when you leave company image, available in high resolution for all your screens.

Dynamic What Happens 401k When You Leave Company Picture Nature

A captivating what happens 401k when you leave company scene that brings tranquility and beauty to any device.

Vivid What Happens 401k When You Leave Company Design Art

Discover an amazing what happens 401k when you leave company background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vivid What Happens 401k When You Leave Company Image for Your Screen

Transform your screen with this vivid what happens 401k when you leave company artwork, a true masterpiece of digital design.

:max_bytes(150000):strip_icc()/GettyImages-1553794991-dbfbf6f283984a1fa229d63a4f7a8dcf.jpg)

Beautiful What Happens 401k When You Leave Company Image in HD

Explore this high-quality what happens 401k when you leave company image, perfect for enhancing your desktop or mobile wallpaper.

Vivid What Happens 401k When You Leave Company Photo for Desktop

Experience the crisp clarity of this stunning what happens 401k when you leave company image, available in high resolution for all your screens.

Serene What Happens 401k When You Leave Company Picture Concept

Discover an amazing what happens 401k when you leave company background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vibrant What Happens 401k When You Leave Company Capture for Desktop

Experience the crisp clarity of this stunning what happens 401k when you leave company image, available in high resolution for all your screens.

Stunning What Happens 401k When You Leave Company Scene Digital Art

This gorgeous what happens 401k when you leave company photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Vivid What Happens 401k When You Leave Company Abstract Art

Experience the crisp clarity of this stunning what happens 401k when you leave company image, available in high resolution for all your screens.

Download these what happens 401k when you leave company wallpapers for free and use them on your desktop or mobile devices.