Sick Leave Tax Credit: Everything Small Businesses Need to Know

Are you a small business owner navigating the complexities of tax relief measures? Dealing with employee absences, especially due to sickness, can be costly. Fortunately, the government introduced mechanisms, primarily through the Families First Coronavirus Response Act (FFCRA), to help offset these costs. This mechanism is known as the Sick Leave Tax Credit.

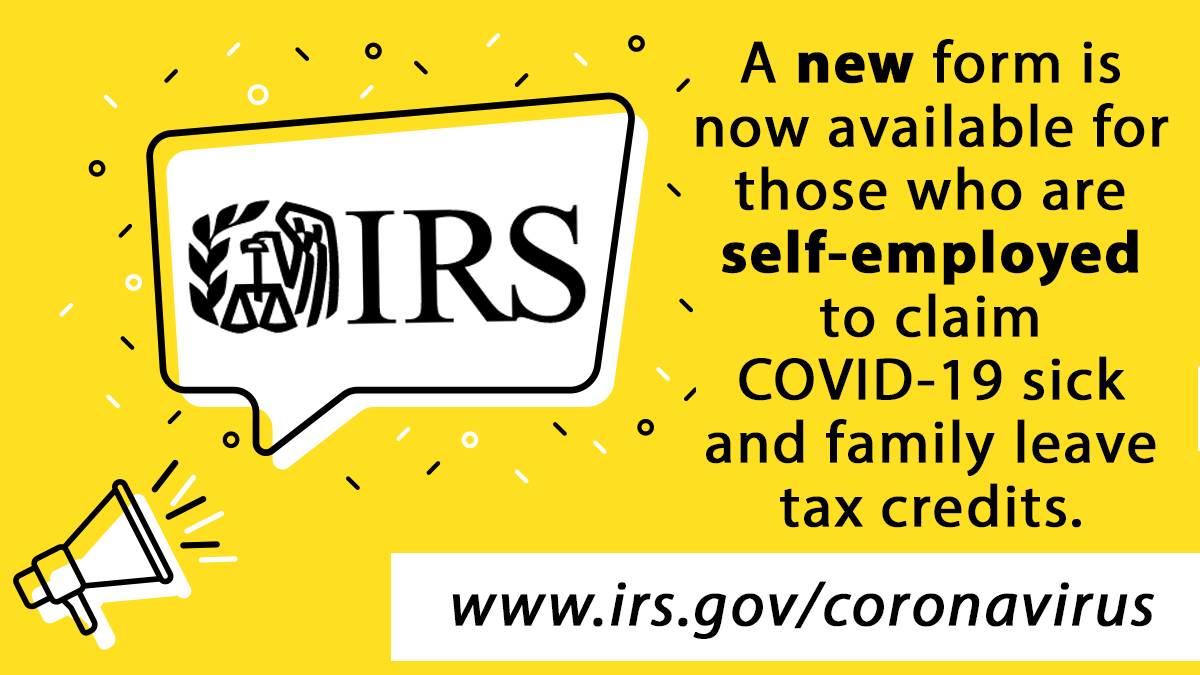

This credit isn't just a simple deduction; it's a refundable credit designed to reimburse eligible employers for the cost of providing paid sick and family leave related to COVID-19 absences. While the mandatory leave provisions have ended, many businesses still need to understand how to claim or adjust previously claimed credits. Let's break down exactly what this credit entails, who qualifies, and how you can ensure you've capitalized on this crucial relief program.

What Exactly Is the Sick Leave Tax Credit?

In simple terms, the Sick Leave Tax Credit is a benefit that allowed employers to receive a tax credit equal to 100% of the qualified sick leave wages and qualified family leave wages they paid to employees. This program was initially mandatory under the FFCRA, which mandated paid leave for specific COVID-19-related reasons.

This credit was fully refundable, meaning that if the amount of the credit exceeded the employer's share of certain payroll taxes, the employer would receive the difference as a refund. This was a significant boost for small businesses trying to keep their operations running while prioritizing employee health.

The History Behind the Credit: FFCRA and Beyond

The foundation of the Sick Leave Tax Credit lies in the Families First Coronavirus Response Act (FFCRA), enacted in March 2020. This act created two types of paid leave: Emergency Paid Sick Leave (EPSL) and Emergency Family and Medical Leave (EFML).

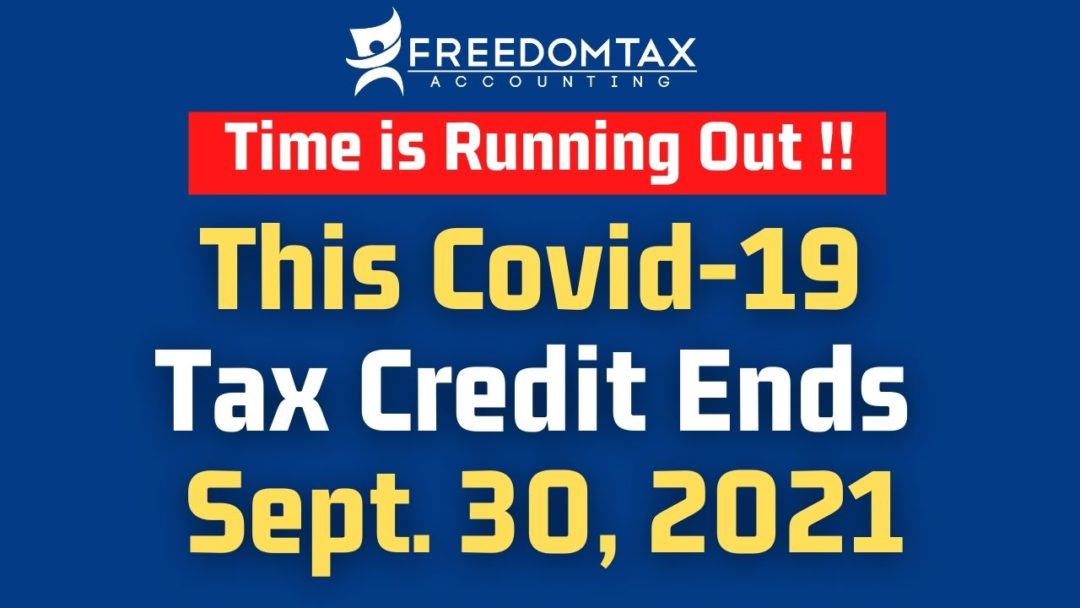

While the mandatory requirement to provide FFCRA leave expired at the end of 2020, subsequent legislation, notably the Consolidated Appropriations Act, extended the tax credits through Q1 2021. The American Rescue Plan Act (ARPA) further extended and expanded the credit for wages paid through September 30, 2021, though the leave provision itself remained voluntary after December 31, 2020.

Understanding these different phases is critical, as the calculation methods and maximum benefits changed slightly over time.

Who Qualifies for This Relief?

Eligibility for the Sick Leave Tax Credit is split into two major components: employee eligibility (the reason for the leave) and employer eligibility (the size and type of business).

It's important to remember that these credits are primarily available to businesses with fewer than 500 employees. Larger organizations generally did not qualify for this specific credit.

Employee Eligibility Criteria

To qualify for the tax credit, the paid leave had to be given for very specific, COVID-19-related reasons. These reasons determined whether the employer could claim the full amount or a two-thirds amount of the employee's pay. The reasons generally included:

- The employee was subject to a federal, state, or local quarantine or isolation order related to COVID-19.

- The employee was advised by a healthcare provider to self-quarantine due to COVID-19 concerns.

- The employee was experiencing COVID-19 symptoms and seeking a medical diagnosis.

- The employee was caring for an individual subject to a quarantine or isolation order or advised to self-quarantine.

- The employee was caring for a child whose school or place of care was closed or unavailable due to COVID-19 precautions.

For the optional periods (2021), new qualifying reasons were sometimes added, such as seeking or recovering from a COVID-19 vaccine.

Employer Eligibility: Are You Covered?

The eligibility rules were designed specifically to support small to mid-sized businesses. If your business had fewer than 500 employees when the leave was taken, you were likely eligible to claim the credit.

There was a critical exception for very small businesses, those with fewer than 50 employees, which could potentially claim an exemption from providing leave related to childcare if doing so would jeopardize the viability of the business. However, even these businesses might have chosen to provide the leave and claim the resulting Sick Leave Tax Credit.

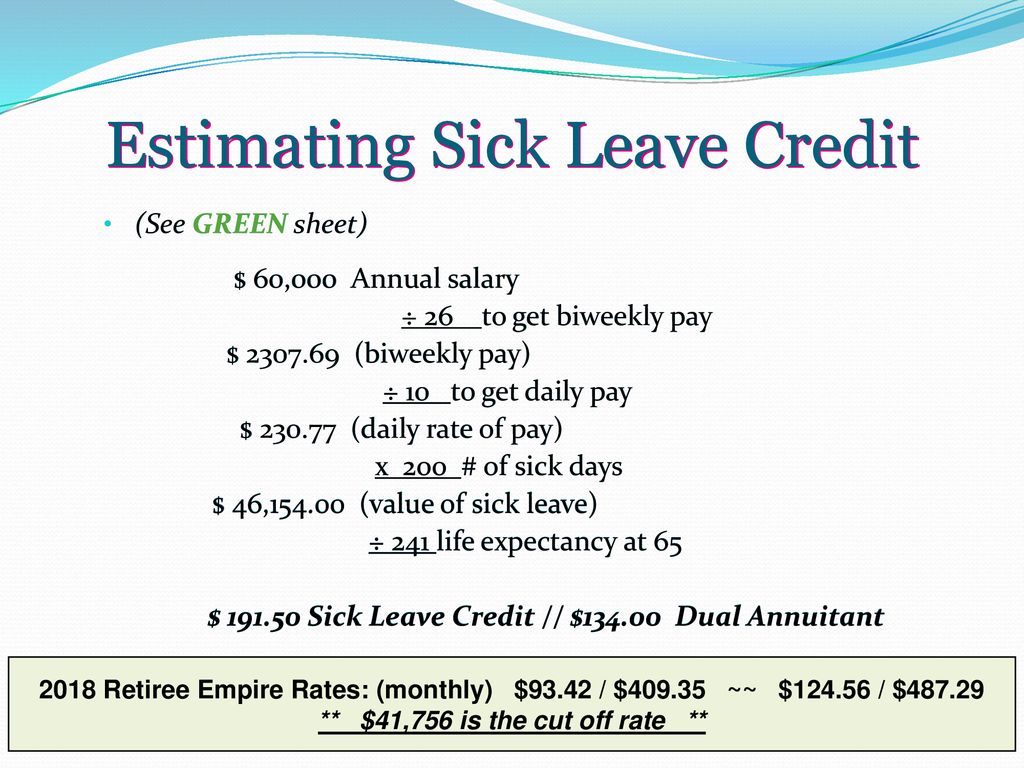

Calculating Your Sick Leave Tax Credit

Calculating the credit isn't just about the wages paid. The credit covers the qualified wages, plus the costs of the employer's share of Medicare tax on those wages, and qualified health plan expenses allocable to those wages.

The actual wage limit depends entirely on the reason the employee took the sick leave, as defined by the FFCRA guidelines.

How Much Can You Claim?

The limits are based on the type of leave provided:

- Employee's Own Illness/Quarantine (Self-Care): For employees using sick leave because they were sick, quarantined, or seeking diagnosis, the pay rate must be 100% of their regular pay, up to a maximum of $511 per day. This benefit was capped at 80 hours (10 days total) per employee.

- Caring for Others: For employees using sick or family leave to care for another individual or for childcare purposes, the pay rate must be at least two-thirds (2/3) of their regular pay, up to a maximum of $200 per day.

If the leave was for caring for others (Reason #2), the total credit cap was higher if the employee qualified for extended family leave. For family leave, the total credit limit could reach $12,000 per employee, depending on the period the leave was taken.

The Simple Steps to Claiming the Credit

For most businesses, the easiest way to access the Sick Leave Tax Credit was by reducing their required federal employment tax deposits, including the amounts withheld from employees' wages, up to the amount of the anticipated credit.

If the anticipated credit exceeded the employer's total federal employment tax liability for that quarter, the employer could file Form 7200, Advance Payment of Employer Credits Due to COVID-19. This allowed the business to receive the remaining credit amount quickly, providing immediate liquidity.

Regardless of whether an advance was requested, the final reconciliation and formal claim were made on Form 941 (Employer's Quarterly Federal Tax Return) or the appropriate annual return (like Form 944) for the quarters in which the qualified wages were paid.

Crucial Documentation: Remember, the IRS requires meticulous record-keeping. You must keep documentation showing the employee's name, the dates and specific reasons for the leave, and the calculation used to determine the amount of qualified sick leave wages.

Conclusion

The Sick Leave Tax Credit offered essential financial protection for small businesses throughout a challenging period. It provided direct relief by covering the costs of mandated or voluntarily extended paid leave, ensuring that employees could stay home when sick without putting undue financial pressure on their employers.

If you claimed this credit, ensure all your Form 941 filings and supporting documents are accurate and complete. If you missed claiming the credit for eligible wages paid between 2020 and 2021, you might still be able to file an amended return (Form 941-X) to claim the refund owed to your business. Navigating these credits can be complex, so consulting with a tax professional specializing in payroll credits is highly recommended.

Frequently Asked Questions (FAQ) About the Sick Leave Tax Credit

- What time period did the Sick Leave Tax Credit cover?

- The FFCRA mandated leave and associated credits covered leave taken between April 1, 2020, and December 31, 2020. Subsequent legislation (ARPA) allowed employers to voluntarily claim the credit for qualified leave wages paid through September 30, 2021.

- Is the Sick Leave Tax Credit still available today?

- No. The credit only applies to qualified wages paid during the specific periods outlined in the legislation (ending September 30, 2021). However, businesses that paid eligible wages during those periods and have not yet claimed the credit may still be able to do so by filing an amended quarterly tax return (Form 941-X).

- Does the credit only cover wages?

- No. The refundable Sick Leave Tax Credit covers three components: the qualified wages paid to the employee, the allocable cost of providing qualified health plan expenses to the employee during the leave period, and the employer's share of Medicare tax on those wages.

- What if my business has fewer than 50 employees?

- Businesses with fewer than 50 employees were generally eligible for the credit. They could, however, claim an exemption from providing childcare-related family leave if doing so would jeopardize the viability of the business. Even if exempt, if they chose to provide the leave, they could claim the Sick Leave Tax Credit.

- What form do I use to claim the Sick Leave Tax Credit?

- The credit is claimed on Form 941, Employer's Quarterly Federal Tax Return, for the relevant quarter. If you need to amend a previously filed return, you must use Form 941-X.

Sick Leave Tax Credit

Sick Leave Tax Credit Wallpapers

Collection of sick leave tax credit wallpapers for your desktop and mobile devices.

Vivid Sick Leave Tax Credit Picture Photography

Experience the crisp clarity of this stunning sick leave tax credit image, available in high resolution for all your screens.

Artistic Sick Leave Tax Credit Capture Photography

A captivating sick leave tax credit scene that brings tranquility and beauty to any device.

Dynamic Sick Leave Tax Credit Landscape in 4K

A captivating sick leave tax credit scene that brings tranquility and beauty to any device.

Vibrant Sick Leave Tax Credit Capture for Desktop

Explore this high-quality sick leave tax credit image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant Sick Leave Tax Credit Background for Desktop

Experience the crisp clarity of this stunning sick leave tax credit image, available in high resolution for all your screens.

Detailed Sick Leave Tax Credit Wallpaper Collection

Explore this high-quality sick leave tax credit image, perfect for enhancing your desktop or mobile wallpaper.

Gorgeous Sick Leave Tax Credit Picture Photography

This gorgeous sick leave tax credit photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Serene Sick Leave Tax Credit View for Your Screen

Discover an amazing sick leave tax credit background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Stunning Sick Leave Tax Credit Design Collection

A captivating sick leave tax credit scene that brings tranquility and beauty to any device.

Vibrant Sick Leave Tax Credit Design in HD

Transform your screen with this vivid sick leave tax credit artwork, a true masterpiece of digital design.

Serene Sick Leave Tax Credit Abstract for Desktop

Discover an amazing sick leave tax credit background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite Sick Leave Tax Credit Artwork Photography

A captivating sick leave tax credit scene that brings tranquility and beauty to any device.

Vivid Sick Leave Tax Credit Wallpaper in HD

Discover an amazing sick leave tax credit background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Beautiful Sick Leave Tax Credit Abstract Concept

Explore this high-quality sick leave tax credit image, perfect for enhancing your desktop or mobile wallpaper.

Artistic Sick Leave Tax Credit Moment Nature

Immerse yourself in the stunning details of this beautiful sick leave tax credit wallpaper, designed for a captivating visual experience.

Vibrant Sick Leave Tax Credit Scene Illustration

Discover an amazing sick leave tax credit background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite Sick Leave Tax Credit Landscape for Desktop

A captivating sick leave tax credit scene that brings tranquility and beauty to any device.

Exquisite Sick Leave Tax Credit Image for Your Screen

A captivating sick leave tax credit scene that brings tranquility and beauty to any device.

Breathtaking Sick Leave Tax Credit Image Photography

Explore this high-quality sick leave tax credit image, perfect for enhancing your desktop or mobile wallpaper.

Stunning Sick Leave Tax Credit Moment Concept

A captivating sick leave tax credit scene that brings tranquility and beauty to any device.

Download these sick leave tax credit wallpapers for free and use them on your desktop or mobile devices.